The Headline

Yesterday, the Federal Reserve announced that it is keeping interest rates unchanged, delaying expected cuts as inflation remains above target and the job market stays strong¹. This decision means higher costs for homebuyers, businesses, and borrowers, slowing economic growth and consumer spending².

People Impact:

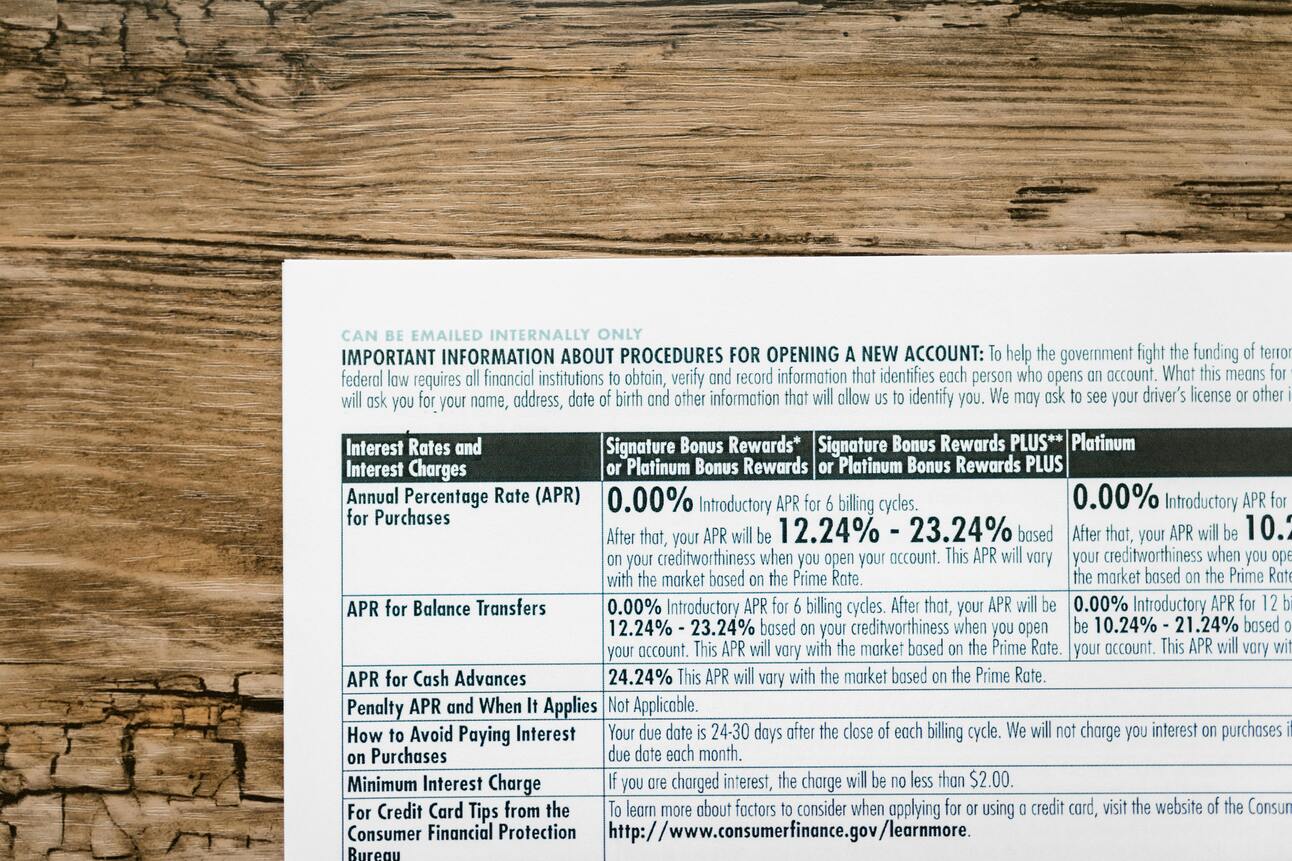

Americans will continue facing high borrowing costs in daily life. Mortgage rates have hovered above 6.5% for months, keeping homeownership out of reach for many³. Car loans and credit card interest rates remain at multi-decade highs, making debt repayment more expensive⁴. Businesses that rely on loans for growth and hiring will struggle with higher financing costs, potentially leading to slower job creation and wage growth⁵.

The Fed’s key interest rate remains at 4.25%-4.50%, and most economists expect only one or two cuts in 2025, delaying financial relief⁶. In late 2024, the Fed began lowering rates after aggressive hikes, but with inflation still above 2% and unemployment steady at 4%, policymakers are unwilling to cut too soon⁷.

Political Context

The Fed is now at the center of a political debate over economic strategy. President Donald Trump wants immediate rate cuts, arguing that high borrowing costs are hurting businesses and consumers⁸. However, Fed Chair Jerome Powell insists the central bank must remain independent, basing decisions on economic stability rather than political pressure⁹.

Businesses warn that prolonged high rates could slow investment and hiring, while consumer advocates argue that low-income and middle-class families are the hardest hit by expensive debt¹⁰. With Trump’s tariffs on steel, aluminum, and Chinese imports pushing inflation higher, Powell’s reluctance to cut rates may become a major talking point in the 2026 elections¹¹.

Republicans argue that the Fed is moving too slowly, cautioning that high rates could harm job growth and economic expansion¹². Meanwhile, Sen. Elizabeth Warren and other Democrats are pressuring Powell to cut rates sooner, pointing out that past rate cuts have been implemented much faster under different economic conditions¹³.

Policy Considerations

The Fed’s decision to hold rates steady comes alongside new trade policies that could further impact inflation. Trump’s latest tariffs on imported goods are expected to raise prices, potentially keeping inflation higher for longer¹⁴.

Homebuyers, small businesses, and corporations reliant on financing for growth will continue to feel the impact of high borrowing costs¹⁵. If inflation does not fall as expected, the Fed may delay cuts well into 2026, affecting housing affordability, consumer spending, and overall U.S. economic growth¹⁶.

Profits & Economics

Markets reacted cautiously to Powell’s announcement. Stocks initially dipped but later stabilized as investors adjusted to the likelihood of delayed rate cuts¹⁷.

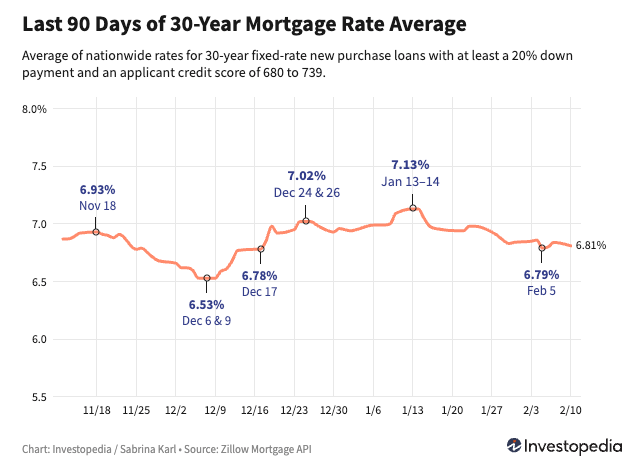

In the housing market, 30-year mortgage rates remain near 7%, keeping homeownership unaffordable for many buyers¹⁸. Retailers and manufacturers, which rely on loans for inventory and expansion, are scaling back hiring and investment due to high interest rates¹⁹. Meanwhile, banks continue to benefit from higher lending rates, but face growing scrutiny over regulatory oversight and concerns about “debanking”²⁰.

Inflation is expected to remain at 2.5%-2.7% through 2025, meaning rate cuts may not happen until late 2025 or even 2026²¹.

Global Perspectives

The Fed’s decision affects markets beyond the U.S. China, the European Union, and Mexico are closely watching U.S. interest rate policy, as high U.S. rates influence global investment flows and currency values²².

Trump’s trade policies are also adding to global uncertainty. China has retaliated against new U.S. tariffs, and other trading partners may follow, increasing inflation risks and complicating the Fed’s timeline for rate cuts²³. A stronger U.S. dollar, driven by high interest rates, makes American exports more expensive, impacting multinational corporations and global trade²⁴.

Chart of the Day

30-year mortgage rates have remained above 6.5% for the past 90 days, reflecting the Fed’s decision to keep rates steady. Powell confirmed that rate cuts aren’t coming soon, so homebuyers should watch for rate dips and consider locking in lower rates when possible.

Globe & Arrow

Globe & Arrow simplifies the latest in business, policy, politics, and global affairs—delivered daily, straight to your inbox. Subscribe now.

Today’s Citations

1, 6, 13 NPR – Federal Reserve Signals No Rush to Cut Interest Rates

2, 5, 7, 14 CNBC – Powell Says Fed Doesn’t Need to Rush Interest Rate Cuts

3, 8, 15 US News – Powell: No Hurry to Lower Interest Rates, Economy Strong

4, 9, 12, 16 CNN – Fed Chair Powell Faces Senate Scrutiny on Interest Rates

10, 11 WCVB – Sen. Warren Urges Fed Chair Powell to Cut Interest Rates